Global Energy Company Ranking Post 2014 Oil Price Collapse

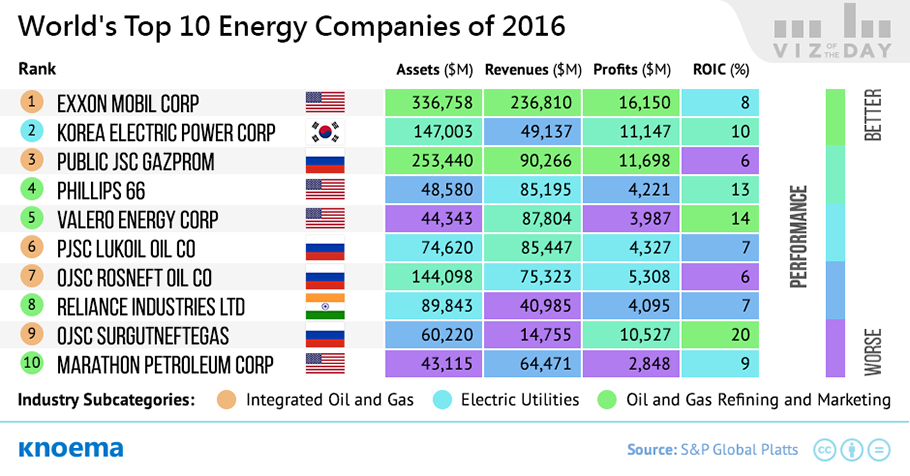

АрхивExxonMobil has yet again taken the top spot in the annual Global Energy Company Ranking by S&P Global Platts. While few were surprised that the assets, revenue, profits, and return on investment capital for the world’s largest public oil and gas producer earned it the 12th consecutive top ranking, the company hot on Exxon’s heels was a surprise: Korea Electric Power Corp (KEPCO). Look no further that oil and gas market fundamentals to understand how KEPCO moved up the ranks.

The 2016 edition reflects the oil market's biggest price collapse in nearly three decades and the resulting re-drawing of the lines in the fuels mix and the business fate of energy players based on each company's exposure to the price rout that followed OPEC's defense of its market position. Enter, KEPCO. The South Korean utility company is the only electric utility in the prized upper ranks. The company's rise from 41st place in 2015 was boosted by a mix of lower fuel costs and costs of purchasing electricity as well as a market reward for risk-taking in a new capacity building that includes new baseload nuclear and coal-fired power plants.

Oil and gas companies that typically dominate the upper rankings met with varied fates this year. Four Russian companies ranked among the Top 10, more than in other edition. Although still dogged by Western sanctions, Russia's biggest energy companies enjoyed a major balance sheet lift from the sharp slump in the value of the ruble. Gazprom climbed to third overall from 43rd place in 2015, the highest since 2011. In contrast, the drop in global oil prices hit the balance sheets and ranking of many industry giants, such as Shell, Chevron, ConocoPhillips, CNOOC, PetroChina.

Download

Download

Download our latest ENERGY cheat sheet

It's a one pager PDF full of live links to energy-related data, statistics, and dashboards from leading industry sources. It will be a useful resource for any analyst, business executive, or researcher with an interest in the oil & gas industry, energy companies, biofuels and much more.

Материалы по теме

Crude Oil Price Forecast: Long Term 2017 to 2030 | Data and Charts

Oil prices grew by 1.1 percent in September modestly rebounding from a 7 percent drop in July. Since January, when the price of Brent crude reached a 12-year low, oil prices have rebounded by 50 percent and nearly reached last year's average of $46.99 per barrel. Barring any market surprises, a further recovery of oil prices hinges on a reduction of oil production by OPEC member states in the fourth quarter. Fluctuations in global crude oil prices have always been the focus of the economic and financial news. The higher crude oil prices rise, the more positive is the economic outlook for petroleum exporters. In contrast, countries dependent...

Coal Prices Forecast: Long Term 2017 to 2030 | Data and Charts

2016 was an exceptional year for coal prices. The period of decline which began in 2011, was interrupted by the rapid growth. Coal prices grew by 7-10 percent in November continuing a 24-29 percent growth in October. Since January, when the price of coal reached a 10-year low, coal prices have rebounded by about 100 percent. This situation is attributable to several factors. First, it is the consequence of an implemented policy in China which aimed at reducing harmful emissions. China is the largest coal consumer and coal producer at the same time. The reduction in own-grown production led to the increase in coal imports. Second, not only...

Natural Gas Prices Forecast: Long Term 2017 to 2030 | Data and Charts

Autumn and winter are traditionally characterized by the growth in energy consumption and, thus, in prices for energy products. Still, natural gas prices in the US, Europe, and Japan showed different dynamics in November. Thus, the spot price of natural gas at Henry Hub, US, fell by 15.2% in November compared to the previous month. This decline - which was the sharpest monthly drop since December of 2014 - interrupted a period of steady growth lasting from April. On the contrary, in Europe, average import border price of natural gas surged by 14.4% - the most dramatic monthly increase over the last 17 years. What for the import price of...

BP: World Reserves of Fossil Fuels

According to the latest BP Statistical Review of World Energy, total global reserves, by fossil fuel, are now: Coal - 1,139 billion tonnes Natural Gas - 187 trillion cubic meters Crude Oil - 1,707 billion barrels While these volumes may seem large at a glance, at today's level of extraction and production rates, BP's estimated proved reserves*, by fossil fuel, would be exhausted as follows: Coal - year 2169 Natural Gas - year 2068 Crude Oil - year 2066 BP dutifully acknowledges the abundance of factors that could easily alter these projections, but these factors do not alter the global policy imperitive to support sustainable fossil...