In March, US President Donald Trump issued the “Energy Independence” executive order, requiring the US Environmental Protection Agency to rewrite the Clean Power Plan, a keystone of former President Obama’s efforts to address climate change. According to experts from the Trump administration, rejecting federal support for alternative energy and delaying the full transition of the US economy to renewable resources will reduce the US budget by approximately 18 percent.

- According to Trump, his order represents a historic step toward removing restrictions on US energy and abandoning the rules that cut jobs in the industry. Just as the previous administration touted the employment opportunities of green energy development, the Trump administration is tying new growth in the coal industry to future job growth.

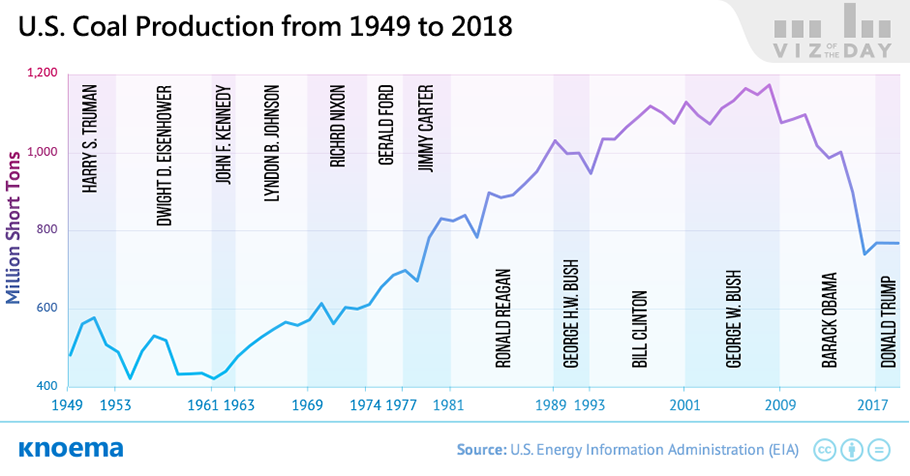

- Under the Obama administration, the US coal industry experienced a perfect storm of regulatory pressure and competition with falling natural gas prices and increasing renewable power generation capacity. During President Obama’s second term from 2012 to 2016, total US coal production declined by more than 25 percent. In 2016, total production fell to its lowest level in 30 years.

While the executive order may seek to revive the coal industry by allowing development of US coal deposits, the US will face challenges meeting the order’s twin aims for energy self-sufficiency and a zero trade balance. The US will have to compete for market share with other coal producers during a period when forecasts show production of coal globally will outstrip growth in coal consumption.

- China and the US are both coal giants. For the last 20 years, China has been the world's largest coal producer and consumer, claiming roughly 45 percent of marketed coal annually. The US proved coal reserves, however, exceed 235 billion tonnes, about double China’s proved reserves.

- According to the latest energy outlook from BP, global coal consumption will grow by roughly 1.5 percent by 2020, yet the supply is expected to outstrip demand by 2035.

- In addition to potentially contributing to a slump in coal prices, the order flies in the face of science by not only supporting coal but by also lifting restrictions on methane emissions from oil and gas development sites. Methane, like CO2, is a greenhouse gas, which is proven to contribute to global warming.

Download

Download

Download our latest ENERGY cheat sheet

It's a one pager PDF full of live links to energy-related data, statistics, and dashboards from leading industry sources. It will be a useful resource for any analyst, business executive, or researcher with an interest in the oil & gas industry, energy companies, biofuels and much more.

Материалы по теме

Global Energy at a Glance

One of the most important trends of the global energy market in 2016 was significant growth of renewables consumption by almost 15 percent. The largest increase was shown by solar energy. For example, solar cumulative installed PV power was increased by 33 percent during 2016. China is the top country by solar energy consumption in the world. As of 2016, solar energy consumption in China was 66.2 terawatt-hours. The top 5 countries also includes the United States, Japan, Germany, and Italy. The trends across key energy sectors are as follows:In the oil sector, Russia overtook the United States by the oil production but Saudi Arabia...

IEA World Energy Outlook 2015

The World Energy Outlook is the International Energy Agency's annual flagship publication that provides long-term projections of energy demand, production, trade and investment, by fuel and by region, under several policy scenarios*. These projections currently extend to 2040. WEO-2015 presents three main scenarios that are differentiated by their energy and climate policy assumptions, with the future energy picture that they portray varying significantly, and introduces a forth in this latest edition:The New Policies Scenario – the central scenario – describes a pathway for energy markets based on the continuation of existing policies and...

BP Energy Production Forecast

Energy Production Forecast | Energy Consumption Forecast Source: BP Energy Outlook 2035, February 2015