Data Driven

Data Driven

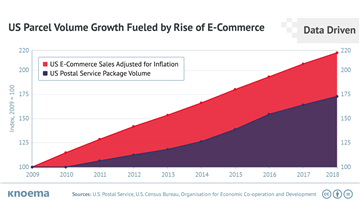

Throughout modern history the postal industry has played a role in connecting people, businesses, and governments around the world. Today we’re witnessing a decline and reinvention in the traditional mail delivery business as fast (and in some cases free) e-commerce options emerge. The Office for National Statistics for the UK reported that online sales made up 18 percent of total retail sales nationally during 2018. High growth rates were also reported in research from IMRG and Capgemini,...

E-Commerce Prompting Innovation by Traditional Postal Services

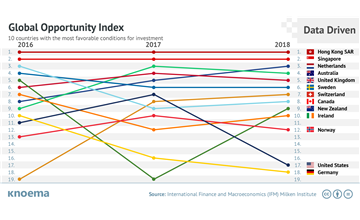

Are you investing in the best economies for your industry's footprint? What factors weigh most heavily on your investment decisions? Is your economy improving in areas that matters most to investors? Economists, investors, and other analysts worldwide rely on multi-economy datasets from the likes of the World Bank and IMF as well as indices to make comparisons across time and countries and address these sorts of questions. The Global Opportunity Index (GOI) developed by the Milken Institute...

The Global Opportunity Index 2018

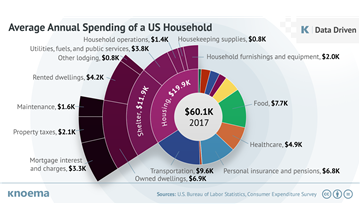

Housing represents a growing source of budgetary pressure for Americans, and the data suggests American's desire for space is at least partially to blame. In 2017, housing represented 33 percent of total US household expenditures, with rent and mortgage—as compared to other household expenses like furnishings and utilities—making up about 60 percent of the household budget, according to the US Bureau of Labor Statistics. Renters have been particularly hard hit, with more than 40 percent...

The High Burden of US Housing Costs

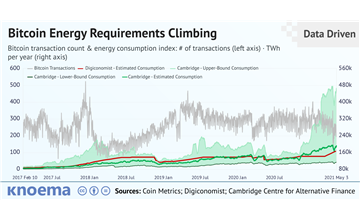

No matter your opinion on the prospect of digital currencies replacing traditional fiat currencies, the fact is that central banks and investors now find themselves evaluating the benefits of and exposure to cryptocurrencies. Today we’re focusing on the market and environmental implications of the large power requirements to mine bitcoin tokens and conduct digital currency transactions in a fossil-fuel dominated world. According to estimates by Dutch bank ING, one bitcoin transaction typically...

Bitcoin Energy Requirements Climbing Even as Revenues Fall

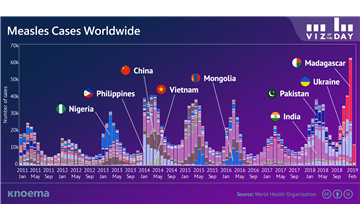

During the first two months of 2019, 74,000 cases of measles were reported globally. A highly contagious, virus borne illness, measles is transmitted through the air, such as when an infected person sneezes or coughs. Of the cases in early 2019, nearly half occurred in January in the African island country of Madagascar (36,869 cases). The official figure for Madagascar in February was down to 10,328 new cases.Europe and South America have been largely spared from new measles cases in 2019....

Measles Outbreak 2019

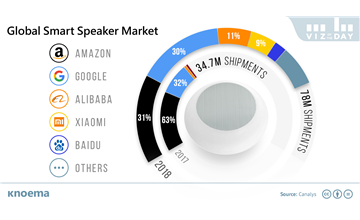

Smart speakers are the fastest-growing consumer technology today, outstripping augmented reality, virtual reality, and even wearables, according to Canalys, a global technology market analyst firm based in Singapore. Worldwide shipments of smart speakers grew to 78 million units in 2018, up 125 percent from 35 million in 2017. In the third quarter of 2018, 42 percent of smart speakers were shipped to the United States, making it the single most important market for smart speakers.Google and...

Smart Speakers Driving Consumer Tech Market

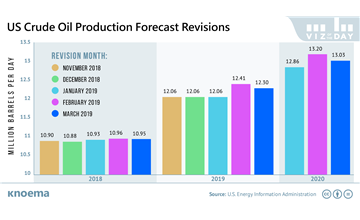

In November 2018, the United States exported a historic 2.6 million barrels of crude oil per day to become the world’s fifth largest exporter of crude oil. While the US is on track to maintain this historic volume of production during the next couple of years, the EIA in March tempered its February production growth forecast, issuing a 0.9 percent downward revision for 2019 and 1.3 percent revision for 2020. The current forecast predicts average 12.3 million b/d production this year and 13...

US Energy Agency Lowers US Oil Production Estimates for 2019-2020

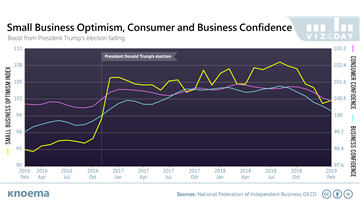

The Index of Small Business Optimism increased 0.5 points in February to 101.7, according to the National Federation of Independent Business (NFIB), ending a 5-month decline during which the index tumbled to the lowest level since US President Trump took office. The decline of small business optimism was amid overall growing economic uncertainty and the partial US government shutdown and tracked with a declining consumer confidence index. As compared to the previous month, more US small...

Small Business Optimism Rebounding After 5-Month Decline

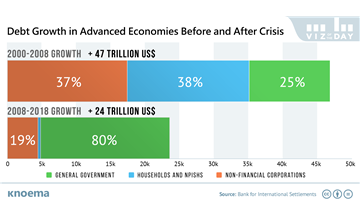

In the 10 years since the 2008-2009 global financial crisis, aka “Great Recession,” the global debt of the non-financial sector increased by 53 percent to reach $178 trillion in the third quarter of 2018, according to the Bank for International Settlements. Global debt, which represents the outstanding credit provided by domestic banks and other institutions to households, non-financial corporations, and government, is quite simply the driver of the modern economy. Over the 2008-2018 period,...

Will Global Debt Expansion Trigger the Next Financial Downturn?

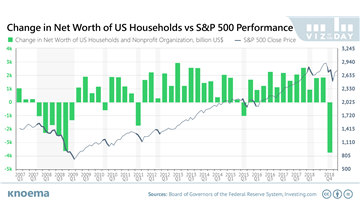

The net worth of US households tumbled 3.5 percent quarter-on-quarter during the fourth quarter of 2018, according to the US Federal Reserve. Only twice since 1952, once in 1962 and again in 2008, was a larger drop reported, and yet for most Americans it’s the proverbial tree falling in the woods: did anyone feel it? The slump in 4Q 2018 is attributable to the poor performance of the stock market in late 2018 and the corresponding hit to the value of household holdings of corporate...

How so Few Americans Noticed the Record Drop in Household Net Worth

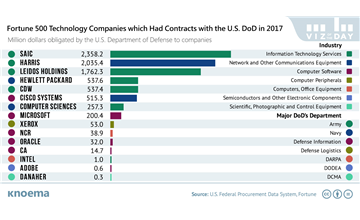

US tech companies are keeping lucrative US Department of Defense (DoD) contracts in their sights as indicated by growing attendance at DoD events. This is unsurprising given the rapid growth of AI technology—which the DoD wants to use in predictive maintenance, process automation, and humanitarian assistance—and the DoD’s long-maintained reliance on private contractors. According to the US Federal Procurement Data System, in 2017, DoD obligated $321 billion to contractors, which is more...

Tech Companies Pursuing Defense Contracts, Employees Hesitant

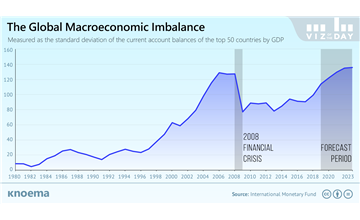

By 2021, the global macroeconomic imbalance may return to the historic 2007-2008 levels that preceded the global financial crisis (aka the Great Depression). A high macroeconomic imbalance may be dangerous as the last time it reached these levels resulted in significant global economic downturn. The global macroeconomic imbalance can be measured as the standard deviation of the annual current account balances (CAB) of the largest economies. As goods and services make up the predominant...

Danger Lurking in Global Macroeconomic Imbalances

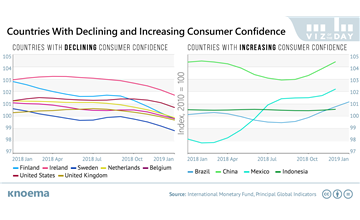

Consumer confidence in the world's biggest economy, the United States, rebounded in February after a sharp drop in January, according to the University of Michigan. January’s decrease was the single sharpest drop in consumer sentiment since 2012 and was at least partially spurred by the partial US government shutdown. In February, the Federal Reserve signaled that it will hold off on further interest rate hikes and trade relations with China continued to thaw, bolstering the rebound. The...

US Consumer Confidence Rebound Spotlights Global Discrepancies

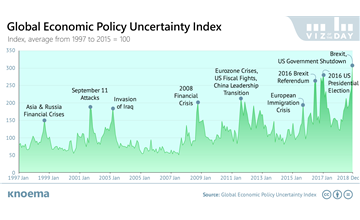

Every day events around the world cause ripple effects that affect global, national, and local levels of economic and political uncertainty. Recent mainstream examples include US sanctions against Venezuela, Brexit, the partial US government shutdown, protests in France, and the US-China trade war. As uncertainty rises, we observe markets responding, whether you're tracking stock prices, commodity prices, or even interest rates. Today we have another more comprehensive measure available to...

Global Events and the Economic Policy Uncertainty Index

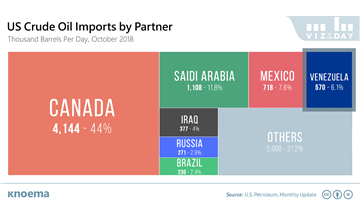

On January 28, 2019, the US announced sanctions against Venezuela's state-owned oil company, PDVSA, a move to restrict socialist President Nicolas Maduro's flow of oil revenues and strengthen the hand of the opposition—led by Juan Guaidó—to trigger elections in Venezuela. The sanctions against PDVSA (and other government-owned companies) are expected to come into force in April. While companies would be permitted to continue commercial transactions, all payments would be held in a "blocked...

Will US Sanctions Move the Political Needle in Venezuela?

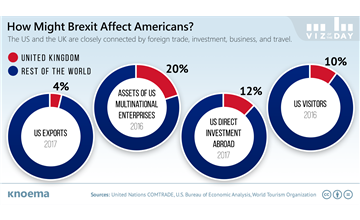

If all goes as planned, March 29, 2019, will go down in history as the day the UK divorced the EU, this despite the UK parliament overwhelmingly rejecting the Brexit deal agreed on November 14, 2018, between Brussels and UK Prime Minister Theresa May. In a drawn out, tightly coordinated exit process, dire consequences in terms of international trade, financial, and even tourism flows can be mitigated. But, what if instead Brexit triggers a domino effect on the global economy because either...

UK Divorcing the EU: Potential Side Effects for the United States

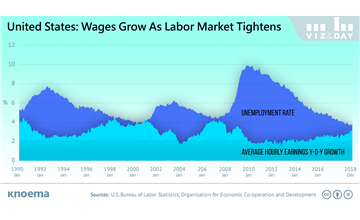

In December 2018, average hourly earnings in the United States increased by 3.2 percent from December 2017, the highest rate increase since May 2009. In addition, due to low inflation American workers saw the largest improvement in real hourly earnings since August 2016. Wages grew because the labor market tightened, as indicated by the historically low unemployment rates. Since rising wages, in general, mean higher inflation, the Federal Reserve may respond by increasing interest rates to...

Will US Wage Growth Lead to Increased Interest Rates?

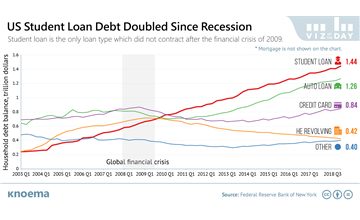

Student loans in the United States represent the second largest type of household debt after home mortgages and were not only impervious to the 2009 recession, but are steadily rising along with total US household debt. As of the third quarter of 2018, student debt outstanding expanded by 2.6 percent, reaching a peak of $1.44 trillion, which is higher than total US auto loans and credit card debt. Total student loan debt has more than doubled since 2009 and grown six-fold over the last 15...

US Student Loan Debt Accumulation Showing No Signs of Slowing

Take a look back through 2018 with the most popular Viz of the Day's from our team at Knoema. Revisit past look backs at the most popular Viz of the Days of 2017 and 2016.

Viz of the Day: The Best of 2018

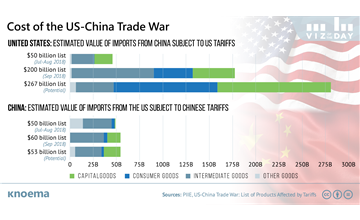

Weeks after US President Donald Trump and Chinese President Xi Jinping agreed to a temporary halt in the US-China trade war, the first positive signs of a return to normal trade relations are emerging. Last week, the China Grain Reserves Corporation (Sinograin) and fellow state-run Chinese enterprise Cofco bought more than 1.5 million tons of US soybeans, the first significant deal since the countries agreed to a 90-day truce from December 1, 2018, to March 1, 2019. The announcement caused a...

US-China Trade War: First Signs of Thaw

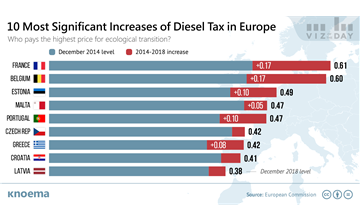

What started on November 17 as a revolt against rising fuel taxes in France has now lasted six consecutive weekends and evolved into a full-blown rejection of the socioeconomic policies of French President Emmanuel Macron. Protestors targeting of stagnant wages, rising prices and taxes, high unemployment in rural areas, pension security, government spending on bureaucrats, university entry requirements, and other issues has yielded some concessions—such as a minimum wage increase—yet protestors...

Protests in France: Clashing Social and Ecological Demands

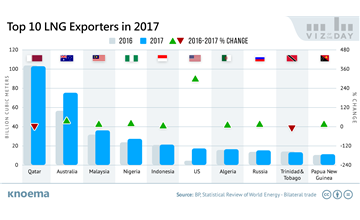

The US shale production boom and recovery of global oil prices following the global financial crisis of 2007-2008 created an attractive environment for new LNG projects. But continued investment and the trade routes that emerge from contracts between producers and consumers are subject to change, as we are witnessing now in the context of the increasingly acrimonious trade dynamic between the United States and China. In August, China floated a 25 percent tariff on LNG imports from the...

Chinese Tariffs on US LNG Exports Reshuffling Market Outlook

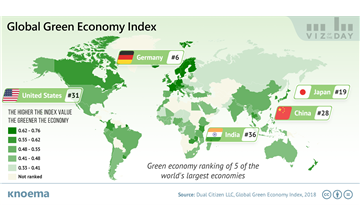

While mainstream media outlets globally may be focused on the relationship between climate change and extreme weather, crop performance, and infrastructure resilience, economists and business strategists alike are turning toward greener measures and outlooks of economic performance. The 2018 Global Green Economy Index (GGEI) by Dual Citizen LLC is one of several initiatives—others include the Green Growth Knowledge Platform and the UN Partnership for Action on Green Economy—working to...

Global Green Economy Index, 2018

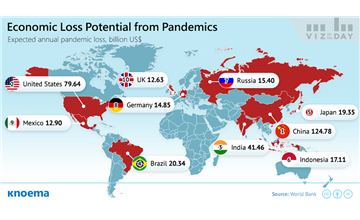

While in some ways technology has changed so much about the world today, it has not been able to erase the vulnerability of diverse populations globally to pandemics, outbreaks, and epidemics that costs lives and undercuts economic growth. In 2016, 1,436 people died due to epidemics, and the global economy lost an estimated $562 billion, which is roughly equivalent to 1.3 percent of global income. This places epidemics on par with some major natural disasters in terms of economic cost.In the...

Epidemic Readiness Still Out of Reach

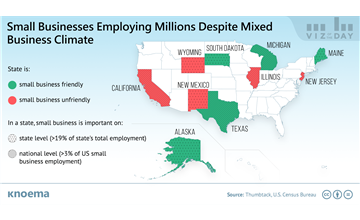

Small businesses in the United States are engines of the American economy, employing nearly 20 percent of Americans. So, what makes one state more small-business friendly than another? The results are in from the Thumbtack Small Business Survey—the largest continuous study of small business perceptions of government policy in the US—and may even surprise you if you associate big cities and large population centers with small business opportunity. #1 South Dakota. Spanning geography and...

Which US States are Small Business Friendly?

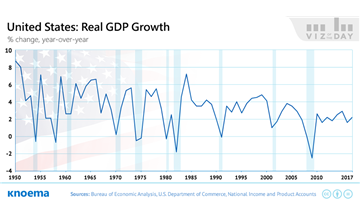

One could argue that in a world subject to the inevitability of business cycles, the United States is overdue for a recession. During the 60 year period from 1950 to 2010, the US economy experienced 10 recessions, averaging one recession every six years. In contrast, the longest period of uninterrupted economic growth was just shy of 10 years. The US is now in the midst of nine years of economic growth with the last "Great Recession" a fading memory for some. Will 2019 bring recession to the...

United States: Moving Toward Economic Recession in 2019?

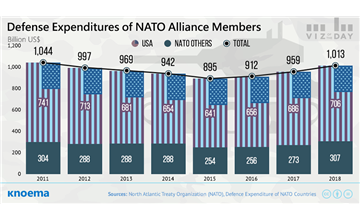

In July, after the NATO summit in Brussels, US President Donald Trump tweeted that "the United States is spending far more on NATO than any other country. This is not fair, nor is it acceptable." But, is the US spending more on NATO than other members? And, if so, is the US spending level unfair relative to that which the US—and the other 28 members—have agreed? Let's look at the data. Measure 1: Defense Expenditures. In 2018,* the US will spend an estimated $706 billion on defense globally....

Is NATO the Financial Burden of the US?

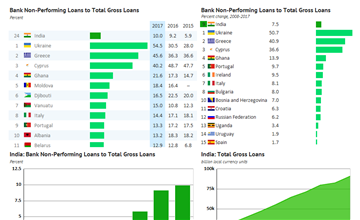

India is not only the third largest economy in the world, but of the top 10 largest economies globally, it has the third highest share of bad loans, too. India's non-performing loans represent 10 percent of total bank loans and about $210 billion of outstanding debt. Since 2008 when attention shifted globally to financial stability and the role of the banking sector, the share of non-performing loans in India has grown by 7.5 percent and is expected to worsen in the coming years, according to...

India Battles to Clean Up Bad Loans That Threaten Its Financial Stability

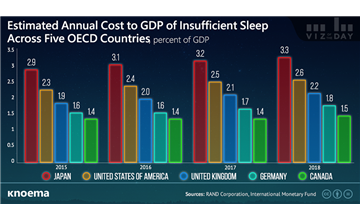

Famous intellects and innovators including the likes of Benjamin Franklin and Nicola Tesla are known not only for their contributions to the world but for doing so on very few hours of sleep per night. We may like to think we could all achieve similar success if we slept less and worked more yet the reality of the human mind and body suggests that insufficient sleep has adverse and far-reaching consequences on our health and well-being and, ultimately, the global economy. The findings of a...

Economic Costs of Insufficient Sleep Across Five OECD Countries

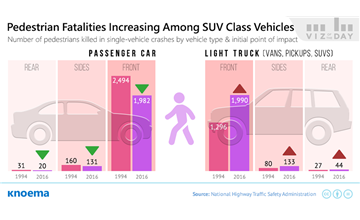

The surge in popularity of sport utlity vehicles in the US has come at a cost, with SUVs overtaking sedans in fatal pedestrian accidents. Experts attribute the higher profile of the front of SUVs—the collision point in most pedestrian collisions—as leading to a higher death rate compared to lower profile sedans. Data from the National Highway Traffic Safety Administration reveals that light trucks—including SUVs, minivans, and pickup trucks—now account for 42.2 percent of pedestrian...

Pedestrians Beware: SUVs are Popular and Deadly

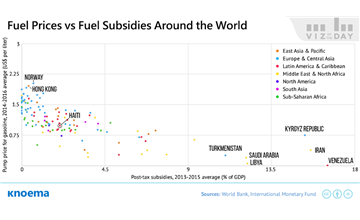

The Government of Haiti on July 6 imposed price hikes for a variety of fuels, sparking violent protests across the country that cost lives, destroyed property, shut down air traffic, and even caused embassies, business, schools, and other entities to restrict transit and activity in the country. The government increased gasoline prices by 38 percent, kerosene by 51 percent, and diesel by 47 percent. Currently, gasoline costs $0.88 per liter while diesel costs $0.7 per liter, according to...

Haitian Public Forcing New Approach to Fuel Price Reform

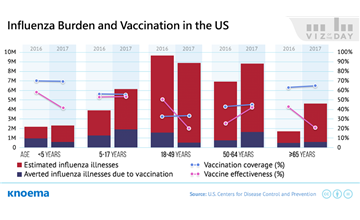

Tens of thousands of Americans have died from the flu during the last five flu seasons, despite US Center for Disease Control and Prevention (CDC) research findings that the flu vaccine reduces the risk of flu illness by 40-60 percent and saves thousands of lives each flu season. A variety of factors contributed to the estimated 30.9 million illnesses, 14.5 million medical visits, 600,000 hospitalizations in the US related to flu during the 2016-2017 flu season. According to the CDC, the two...

US Health Agency Research Supports Vaccinating Against Flu

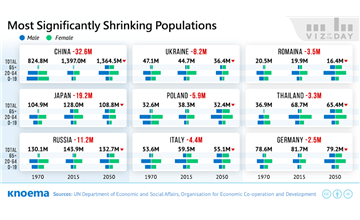

Just as governments struggle to simultaneously address obesity and hunger, the world’s population continues to grow ... and shrink. The United Nations estimates that between 2015 and 2050 49 countries will experience population declines even as the total world population reaches 9.77 billion. Moreover, in all but two countries the ratio of old population to working-age population will increase by 2050, and an estimated 135 countries will experience fertility rates below replacement rates. While...

Shrinking Populations: A Challenge for Pension Systems

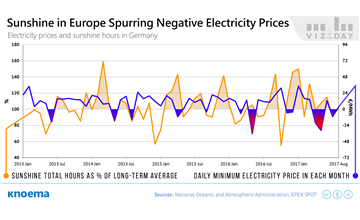

If energy prices are a reliable indicator, then power grids even in green-friendly Europe are not yet ready for a comprehensive transition to renewable energy. Due to lagging investment and development of storage technologies for renewable power, unseasonably sunny and windy periods across Europe continue to lead to imbalances in power supply and demand that result a bizarre phenomenon: negative energy prices. Electricity prices in several European countries, including Belgium, France,...

Negative Prices for Energy in Europe Reveal Infrastructure Gaps

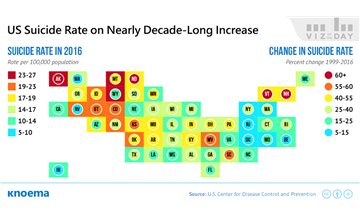

Suicide in the US is now considered a major public health issue. In 2016, 45,000 Americans took their own lives, according to the Centers for Disease Control and Prevention (CDC), a 53 percent increase since just 2000. A recent CDC study on trends in suicide rates by US state revealed that in the period from 1999 to 2016 the suicide rate increased in all but one state, Nevada. Among US states, the suicide rate varied from six deaths per 100,000 population in the District of Columbia to 25 in...

US Suicide Rate

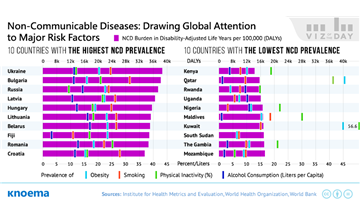

Non-communicable diseases (NCDs) kill about 40 million people annually. Comprising chronic lung diseases, diabetes, cancer and cardiovascular diseases, NCDs are the result of a characteristic Western, predominantly urban lifestyle and negative environmental factors. Almost three-quarters of global NCD deaths arise from low or middle income countries, where the incidence of NCDs is on the rise. - World Economic Forum The major common lifestyle risk factors of non-communicable diseases are...

The Global Burden of Non-Communicable Disease

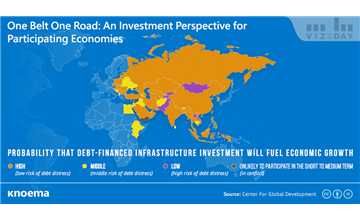

Last year the government of China formally adopted the One Belt One Road Initiative to improve the transport and trading links between China and Eurasian and African countries. A modern day version of the Silk Road network of trade routes between East and West circa 207 BCE, One Belt One Road (aka Belt and Road Initiative or just BRI) will be the largest investment initiative in history. BRI will span more than 68 countries and including an estimated $8 trillion of investment in transportation...

One Belt One Road: An Investment Perspective for Participating Economies

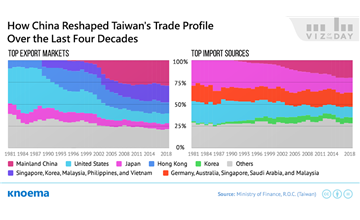

Taiwan, an island off the southwestern coast of China, is the most populous state and largest economy that is not a member of the United Nations. Today, Taiwan is home to 23.7 million people, a population comparable to that of Xinjiang, Beijing, and Shanghai. Despite a recent economic slowdown, Taiwan's GDP per capita stands at $25,000, nearly triple that of China. In terms of PPP, Taiwan ranks 77th in the world; China ranks 108th. While Taiwan is an economic success, the island remains...

Taiwan: Trade Profile Shaped by Bilateral Trade with China

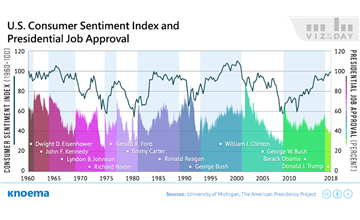

Consumer sentiment among US residents surged in March to its highest value since 2004, according to the University of Michigan. An improving job market, expectations of increased disposable income from tax cuts, and prospects for continued economic growth offset concerns about tariffs and stock market volatility triggered by the US president’s impulsive tweets and policy shifts. Growing confidence should help to stimulate consumer spending, roughly 69 percent of the US economy in the first...

U.S. Consumer Sentiment Index

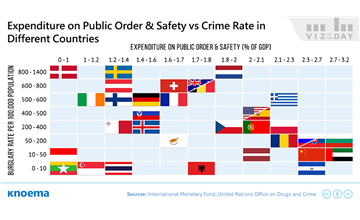

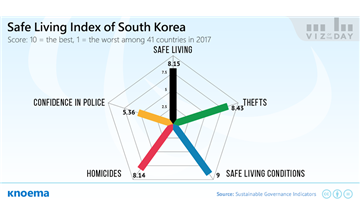

Personal safety, as a basic human need, is encapsulated globally in national legislation and international accords, all with the aim of maintaining public order and safety. While definitions of law and order may vary by country—and with it the tasks assigned to security forces—the source of funding is nearly universally taxpayers. Every taxpayer thereby has the right to know whether these public expenditures are effective. In today’s viz we explore the efficiency of public safety expenditures...

Public Order and Safety Spending Worldwide

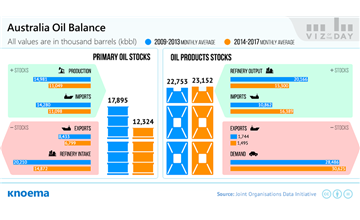

Australia is running a continuous and growing deficit in total oil stocks, defying the International Energy Agency's (IEA) mandate on members to maintain 90-days of coverage and perpetuating the country’s vulnerability to swings in global oil markets. Whether global supply imbalances arise from geopolitical discord, OPEC-sanctioned supply adjustments, or other market balance factors, the fact that Australia maintains no strategic reserve and has less than a 50 day supply of oil bodes poorly for...

Australia: Oil Stock Levels Pose a Systemic Economic Risk

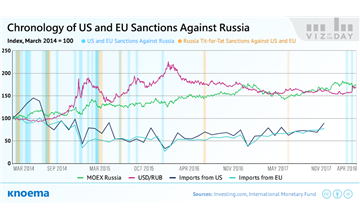

Russia's recovery from economic recession could be complicated by sanctions announced recently by US President Donald Trump, with still greater potential of painful restrictions on investors and Russian companies seeking to raise capital in Western markets. This year, the US Treasury initiated new sanctions against Russian persons and entities for activities including the alleged poisoning in the UK of former FSB Officer Skripal and his daughter as well as Moscow's alleged meddling in the 2016...

US Sanctions Against Russia

Corporate growth strategies typically include some combination of deepening existing market penetration and new product and market development. New market entry through acquisitions, greenfield investment, joint venture or other forms are considered generally to be the most controllable ways to drive business growth. And, many emerging markets, such as Brazil, India, Argentina, with their growing middle-classes are attractive targets for these growth strategies. With the ever-increasing...

The Most Attractive Markets: Understanding China's Market Potential

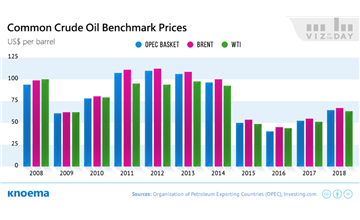

Oil producers market more than 160 unique crude oils today, each varying from light to heavy, with different sulfur levels and other chemical attributes that affect price and market. Only a few individual crudes—particularly Brent and West Texas Intermediate (WTI)—serve as industry benchmarks. The OPEC Reference Basket (ORB) is another common benchmark. The ORB represents a weighted average of prices for the petroleum blends produced by the 14 member states of the Organization of the Petroleum...

OPEC Crude Oil Prices

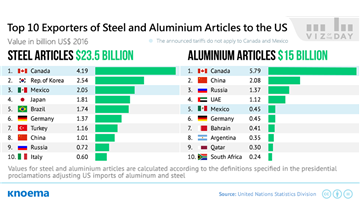

On March 8, 2018, US president Donald Trump issued two proclamations to adjust US imports of aluminum and steel from all countries except Canada and Mexico, key regional allies and trade partners. President Trump asserted that a 25 percent tariff on steel “articles” and a 10 percent tariff on aluminum articles are necessary for the US to develop its domestic steel and aluminum industries and to protect and create jobs. The US is the world's largest importer of the steel and aluminum articles...

US Imports of Steel and Aluminium: Tariffs Perspective

The PyeongChang 2018 Winter Olympic Games XXIII in the Republic of Korea will kick off tomorrow, February 9th, 2018. The fact that the Olympic Committee selected South Korea to host along with the rapidly growing number of international tourist arrivals to the country in recent years suggests that South Korea is a safe and hospitable destination. But, what does the data tell us? Crime. The data tells us that in all likelihood, the flu will be more threatening to tourists and athletes than...

South Korea a Welcoming Locale for the 2018 Winter Olympics

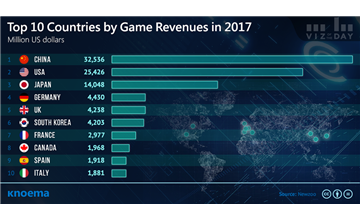

According to the American Time Use Survey, Americans spend an average of 15 minutes daily playing games. That’s more time than Americans spend walking, grocery shopping, or managing their finances. The gaming industry is evolving rapidly. Every producer wants to involve as many users as possible and offers realistic graphics, new opportunities, and tasks to take advantage of the explosive growth in gaming interfaces made possible by the Internet and smartphones. Producers are also increasing...

Top 100 Countries by Game Revenues

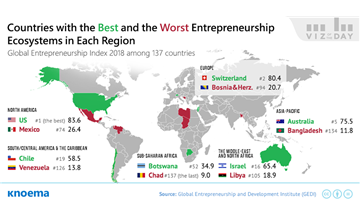

Ecuador has the world's highest share of nascent entrepreneurs per capita at about 30 percent of the population. This measure is known as total early-stage entrepreneurial activity (TEA). But, does this mean that Ecuador is more entrepreneurial than the United States, which has a TEA of only 14 percent? The answer depends on how we define “entrepreneur”. One key global economic growth driver is the ability of an entrepreneur to bring a concept to market, adding to national income, providing...

Global Entrepreneurship Index 2018

How will you remember 2017? Today we recall the 20 most notable data stories of 2017 from Knoema's Viz of the Day series.

Viz of the Day: The Best of 2017

Nine countries in the world are nuclear-capable: China, France, India, Israel, North Korea, Pakistan, Russia, the United Kingdom, and the United States. As of January 2017, these nuclear powers possessed approximately 14,935 nuclear weapons, according to the Stockholm International Peace Research Institute (SIPRI). Almost 40 percent of total nuclear forces are warheads in central storage that would require some preparation to deploy, such as transportation and loading onto launchers.SIPRI...