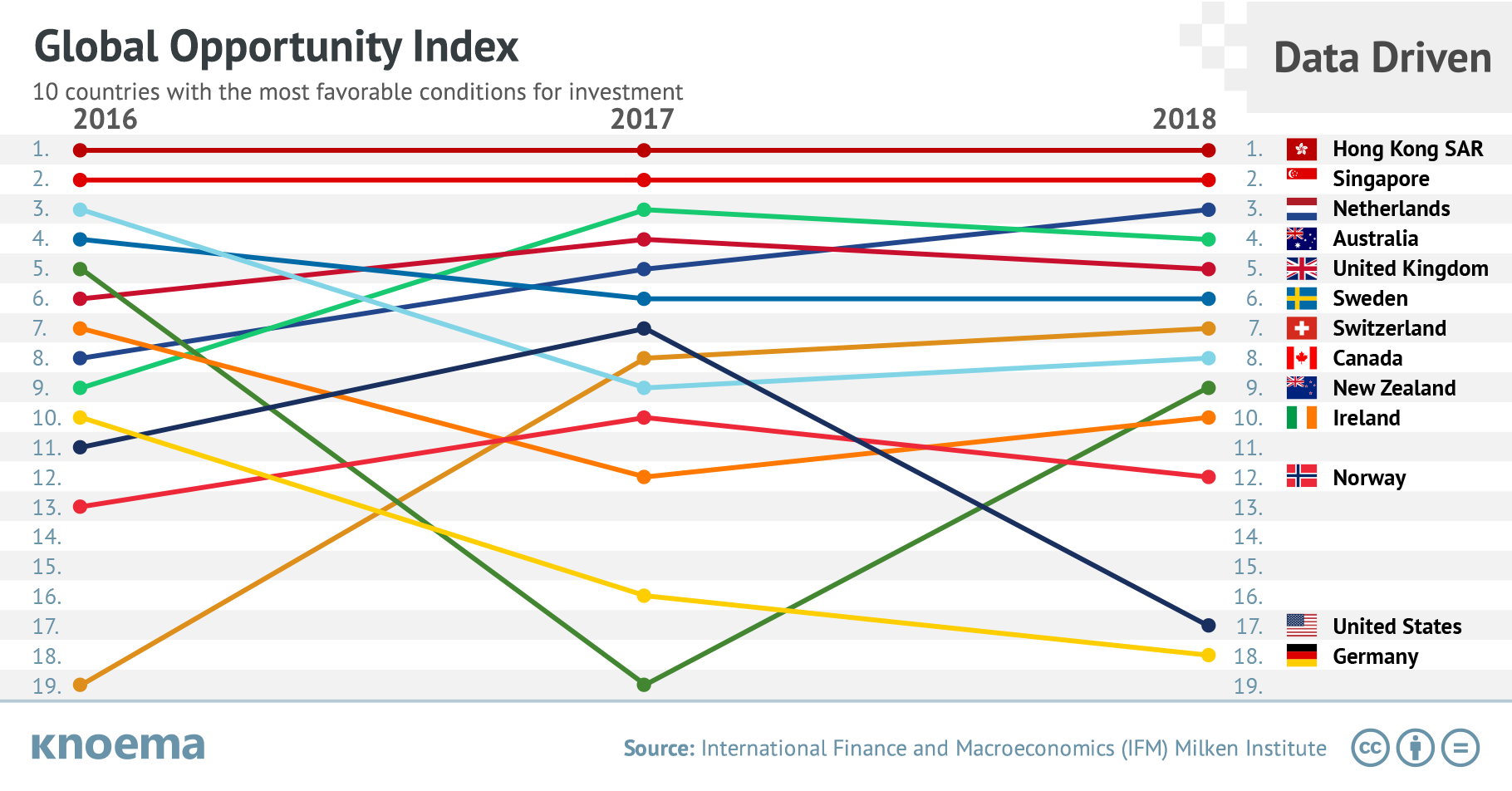

The Global Opportunity Index 2018

Are you investing in the best economies for your industry's footprint? What factors weigh most heavily on your investment decisions? Is your economy improving in areas that matters most to investors? Economists, investors, and other analysts worldwide rely on multi-economy datasets from the likes of the World Bank and IMF as well as indices to make comparisons across time and countries and address these sorts of questions. The Global Opportunity Index (GOI) developed by the Milken Institute delivers one such index to help guide investment decisions and establish baseline estimates for countries seeking to improve their business environments and attract investment. The GOI considers 51 economic and financial factors aggregated across five categories:

- Economic Fundamentals focuses on the macro-performance, trade openness, quality and structure of the labor force, and modern infrastructure of the country.

- Financial Services is mainly based on financial infrastructure evaluation and access to credit.

- Business Perception compares countries by explicit and implicit business costs (e.g. tax burden, transparency, etc.).

- Institutional Framework measures the extent to which an individual country’s institutions provide a supportive network to businesses.

- International Standards and Policy represents the extent to which a country’s institutions, policies, and legal system facilitate international integration by following international standards.

The annual Global Opportunity Index provides a snapshot of the fundamental factors attributed to a strong business environment and exposes some potentially surprising results.

- Hong Kong SAR was top ranked overall on the GOI in 2017 and 2018, and even strengthened its performance between 2017 and 2018. According to the weighted ranking, Hong Kong showed particular strength in 2018 within ‘business perception’ based on low implicit and explicit business costs.

- In contrast, the world’s largest economy, the United States, ranked only 17th overall in 2018 and made the top 10 in only one category: Institutional Framework.

- Work with the data yourself below and examine areas where Luxembourg (Economic Fundamentals), Australia (Financial Services), countries across Asia (Business Perception), New Zealand (Institutional Framework), and Belgium (Standards and Policy) excel globally.

Связанные Insights от Knoema

The Panama Papers: Key Statistics

The Washington, DC-based International Consortium of Investigative Journalists (ICIJ) has released a database of the so-called Panama Papers - information leaked primarily from Mossack Fonseca, one of the world's leading global law firms providing services of incorporation of offshore entities and headquartered in Panama. The leak is the largest ever of offshore financial records and contains about 11.5 million legal and financial records dating back more than 40 years. The files expose more than 213,000 offshore entities created in 21 jurisdictions, stripping away the secrecy from...

Dow Jones Industrial Average Historical Prices, 2007-2019

Dow Jones Industrial Average (DJI) along with S&P 500 and NASDAQ Composite indices is one of the most widely quoted benchmark indices in the world which is considered to be a barometer of the US economic status. The index tracks the performance of 30 large publicly traded companies (or blue chips) based in the United States using price-weighted average metric. Companies, included in the index are listed on the New York Stock Exchange (NYSE) and NASDAQ. Only stocks of companies which has the excellent reputation, demonstrate sustained growth and are of interest to a large number...

S-and-P 500 Index Historical Prices 1985-2016

Standard & Poor's 500 Index (or S&P 500) is market index considered by many as one of the best gauges of the U.S. equity market and U.S. economy as a whole.The index includes 500 leading large-cap companies from leading sectors of the american economy covering 80% of all available market capitalization. To enter the index, company should meet the following membership eligibility criteria: market capitalization should be US$ 5.3 billion or more; company's shares should demonstrate adequate liquidity and be reasonably priced; most recent quarter's earnings as well as their sum...

World markets and currencies performance, 2014

2014 was a challenging year for world markets and for world currencies too. Almost every currency in the world was devalued (more or less) compared to US dollar. Russian ruble (-42%) and Ukraine hryvnia (-47.5%) became "champions" (due to political conflict between those states). UK Pound Sterling and Pakistani Rupee were the strongest. Among the developed markets US was the best (+12.8% price return year-to-date). European markets were, mainly, disappointing (in USD terms, at least). In the emerging world Bangladesh, Egypt, Indonesia, Philippines, Kenya, India, Argentina and...