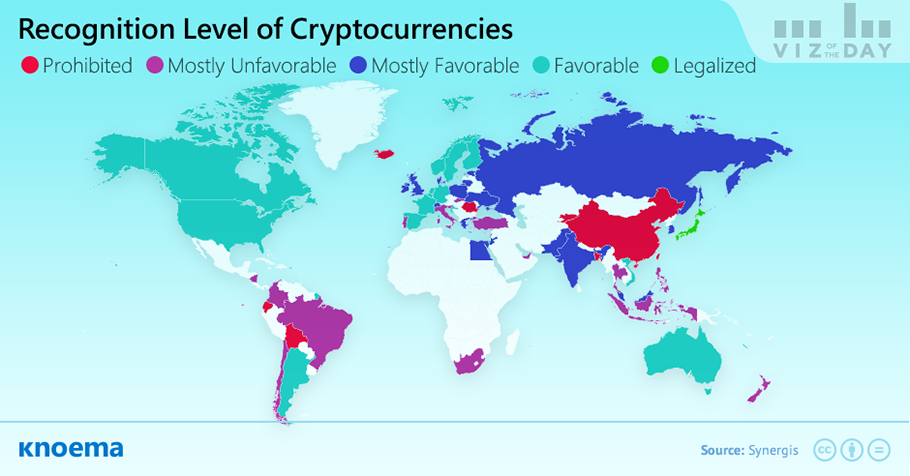

Bitcoins, ethereum, and other cryptocurrencies, commonly known as "digital gold", are gaining exposure globally through various media outlets even though very few countries officially recognize cryptocurrency as legal currency. Official national-level regulatory positions relative to cryptocurrency may be separated into three main groups: totally against, legalized, and uncertain. The most interesting situation is uncertain because of the market basis at stake if governments turn away from digital gold.

- The majority of "uncertain" countries where no regulation is implemented do not recognize cryptocurrencies as a legal means of payment and have expressed concern about the risks the currencies present, even if they have not prohibited the use for a personal medium of exchange. Such countries include Indonesia, Lithuania, Malaysia, the Philippines, Slovakia, South Africa, South Korea, and Thailand. The governments of Lithuania and Malaysia do, however, characterize cryptocurrencies as perspective technology worthy of future investment.

- In contrast, some others, such as Denmark, Ireland, and Colombia, have asserted that bitcoins are not a currency and the governments will not regulate a digital currency market. Brazil, Hong Kong, and Pakistan view the cryptocurrency market as too nascent to regulate, regardless of the official positions on these types of currency.

- Still others prefer to take no official position on cryptocurrencies, including Chile, Cyprus, Greece, Malta, Nicaragua, Portugal, and Turkey.

For those countries with some official recognition of cryptocurrencies, several approaches for regulating the market are being tested with varying levels of favorability toward fostering the growth of digital currency*. No consensus approach has yet emerged from amongst early regulators, including India, New Zealand, Poland, and Switzerland, among others.

- Some countries, such as the United Kingdom and Italy, are following a model under which business operations based on cryptocurrencies are taxed as such.

*Regulations evolve rapidly, so the analysis can differ from recent developments.

Материалы по теме

Bitcoin Price from 2009 to 2018

Bitcoin is one of the world's most popular digital currencies, meaning that it is exclusively created and held electronically. But, what do we actually know about digital currencies and the potential of these currencies to replace conventional money? Like conventional money, the major function of a digital currency is to serve as a means of payment, whether that is in exchange for goods or real currency, such as dollars and euros. In addition, similar to how a normal currency's exchange rate is set, the price for bitcoins - per the CoinDesk Bitcoin Price Index (XBP) - is based on market dynamics and expressed as the...

Belarus Is the Land of Opportunity for Blockchain Development

On December 22, President of Belarus Alexander Lukashenko signed a decree "On the development of the digital economy" on the crypto-currencies. The key idea of decree is legalization and support of crypto-currencies operations, as well as mining and block-building technology at the state level. President Lukashenko appreciates that Belarus has become actually the first country in the world, which opens wide opportunities for blockchain technologies development with possibilities of having every chance to become a regional competence center in this field. The decree does not imply any restrictions on operations for the...

Bitcoin Currency Statistics, 2009-2018

Bitcoins in circulation - the total number of bitcoins that have already been mined; in other words, the current supply of bitcoins on the network. Market Capitalization - the total USD value of bitcoin supply in circulation, as calculated by the daily average market price across major exchanges. USD Exchange Trade Volume - the total USD value of trading volume on major bitcoin exchanges. See also: Bitcoin Price Index, 2009 to 2018