The Global Influence of the United States: A Foreign Investment View

АрхивDespite a global surge in Chinese foreign direct investment during the first half of 2015, the United States remains the leading global financial power based on total foreign direct investment. During 2015, outward US net foreign direct investment (FDI) reached $345.1 billion, an amount that was not only 21.6 percent of total global financial flows but that was also almost twice the total FDI of China. Moreover, American foreign investment in 2015 was nearly five times its total value in 2005, providing a direct opportunity to increase US global influence. So, where in the world does the United States have the most influence, at least in terms of FDI?

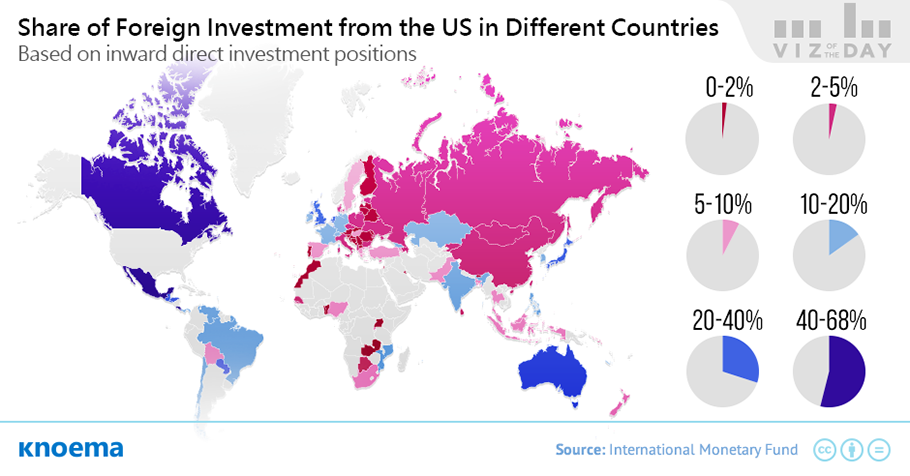

One approach to answering this question is through examination of trends in the share of inward FDI stock from the US on a country-by-country basis. The IMF's Coordinated Direct Investment Survey dataset and the UN’s Bilateral FDI Statistics each provide FDI data by investment source and the recipient country. US influence through FDI is geographically lopsided and generally risk adverse, based on IMF data:

- The United States is especially powerful in the North Atlantic and Caribbean region, where it accounts for almost 70 percent of all foreign investment to the region. Aruba and Costa Rica are among the largest recipients.

- US FDI in the regions of North and Central America constitutes 15 and 13 percent of the total foreign investment stock in each country, respectively. Canada and Mexico receive roughly half of their FDI from neighboring USA.

- Australia, Japan, Luxembourg, the Netherlands, and the United Kingdom all receive their largest shares of FDI from US investors.

- American investors tend to avoid riskier regions, including Northern and Sub-Saharan Africa, as well as the Middle East and South Asia, which report the lowest share of investment from the United States.

Where US FDI is not, Chinese FDI is. The investment void the US has maintained in regions with riskier investment profiles has provided China with an opening to expand its influence.

- For example, American investors have maintained a 1 to 2 percent stake in Zambia's foreign investment stock since 2010, whereas Chinese capital in Zambia grew from 6.12 percent in 2010 to 9.33 percent in 2014.

- Niger now receives one third of its total FDI from China—with notable investments in Niger's energy sector, in particular—while US foreign investment in the country is nonexistent.

Материалы по теме

Buzz word on Developing Economies... Foreign Direct Investment

According to OECD, India is No.14 in terms of receiving FDI from other Countries in the World. China is again No.1 in getting largest amount FDI Investment. And, US is No.2 in getting FDI Investment. On BRICS, Brazil, Russia & China are present in Top 10. Who is making FDI Investment in US?. Explore Datasets Knoema to get the answer... When it comes to Investing in other Countries, India is positioned at 26. As everyone knows, US is No. 1 spot. Curious to know what was the story back in 1990?Just press play button at the bottom of each graph and enjoy. Rest is at your own exploration. Source: OECD FDI Statistics

China: Global Investment Overview, 2015

China’s devaluation of its national currency in early August should make foreign investment by Chinese investors relatively more attractive. Total Chinese foreign investment and construction contracts since 2005 already exceed $1.1 trillion, with new investment in 2015 on pace to top $100 billion. The question becomes: where will Chinese investors take their money next? Increased industry-based diversification could soon overtake a previous focus on geographic diversity for Chinese investments abroad. As the returns on energy investment began to weaken last year, Chinese investors easily shifted their investments in favor of transportation,...

Global Opportunity Index

The Global Opportunity Index answers a pressing need for information that's vital to a thriving global economy. What policies can governments pursue to attract foreign direct investment (FDI), expand their economies, and accelerate job creation. What do multinational companies, other investors, and development agencies need to know before making large-scale, long-term capital commitments. The costs and conditions of doing business are central to the FDI equation. Natural resources and hardworking people have great value, of course, as do a sophisticated banking system and healthy industrial base. But countries that invest in their...

Foreign Direct Investment Country wise

Foreign Direct Investment (FDI) is a category of investment that reflects the objective of establishing a lasting interest by a resident enterprise in one economy (direct investor) in an enterprise (direct investment enterprise) that is resident in an economy other than that of the direct investor. The lasting interest implies the existence of a long-term relationship between the direct investor and the direct investment enterprise and a significant degree of influence (not necessarily control) on the management of the enterprise. The direct or indirect ownership of 10% or more of the voting power of an enterprise resident in one economy by...